FMSB

Institution Overview

Headquarters: Taunusanlage 12, 60325 Frankfurt am Main, Berlin

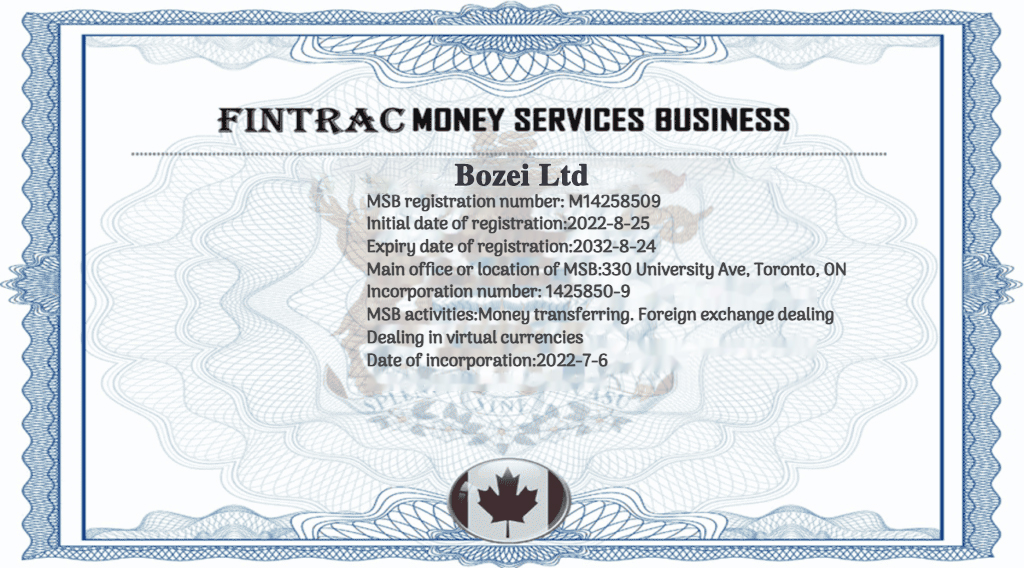

Bozei Ltd is dedicated to providing innovative blockchain technology, cryptocurrency exchange solutions, smart contract security auditing, and NFT marketplace services. We uphold principles of transparency, compliance, and innovation, aiming to provide a secure and convenient virtual asset trading and management platform for global users.

Regulatory Scope

NFT Marketplace and Trading Platform: Providing a blockchain-based NFT asset trading platform that supports the trade of various digital assets and artworks, ensuring compliance with local laws and market regulations.

Blockchain Infrastructure Provider (Layer 1 & Layer 2): Building and operating blockchain technology architecture, including Layer 1 and Layer 2 solutions, to enhance transaction efficiency and security on the platform.

Cryptocurrency Payment Services: Providing cryptocurrency payment solutions that allow users to make fast and secure virtual currency payments globally.

License Categories

Bozei Ltd Blockchain License: The blockchain technology license we hold allows us to legally operate a blockchain technology platform, including the creation, management, and auditing of smart contracts.

Bozei Ltd Crypto Exchange License: As a compliant cryptocurrency exchange platform, we hold a cryptocurrency exchange license to ensure we provide efficient, secure, and regulatory-compliant digital asset trading services.

Bozei Ltd DeFi License: To support the growth of decentralized financial services, we hold a decentralized finance (DeFi) license, offering DeFi products and services that meet regulatory requirements and ensure investor protection.

License Application Requirements

Minimum Capital Requirement: $10,000,000 (Ten Million USD), to ensure the platform’s stable operation and compliance.

NFT Marketplace Transparency: For platforms operating an NFT marketplace, an intelligent contract transparency report must be provided to ensure transparency of transactions and assets, as well as the security of smart contracts.

Compliance Audits: The platform must undergo regular compliance audits to ensure continued regulatory adherence and protect investor rights.

Risk Management Framework: The platform must establish a sound risk management system, including Anti-Money Laundering (AML) and Know Your Customer (KYC) processes, to ensure the legality and transparency of all transactions.