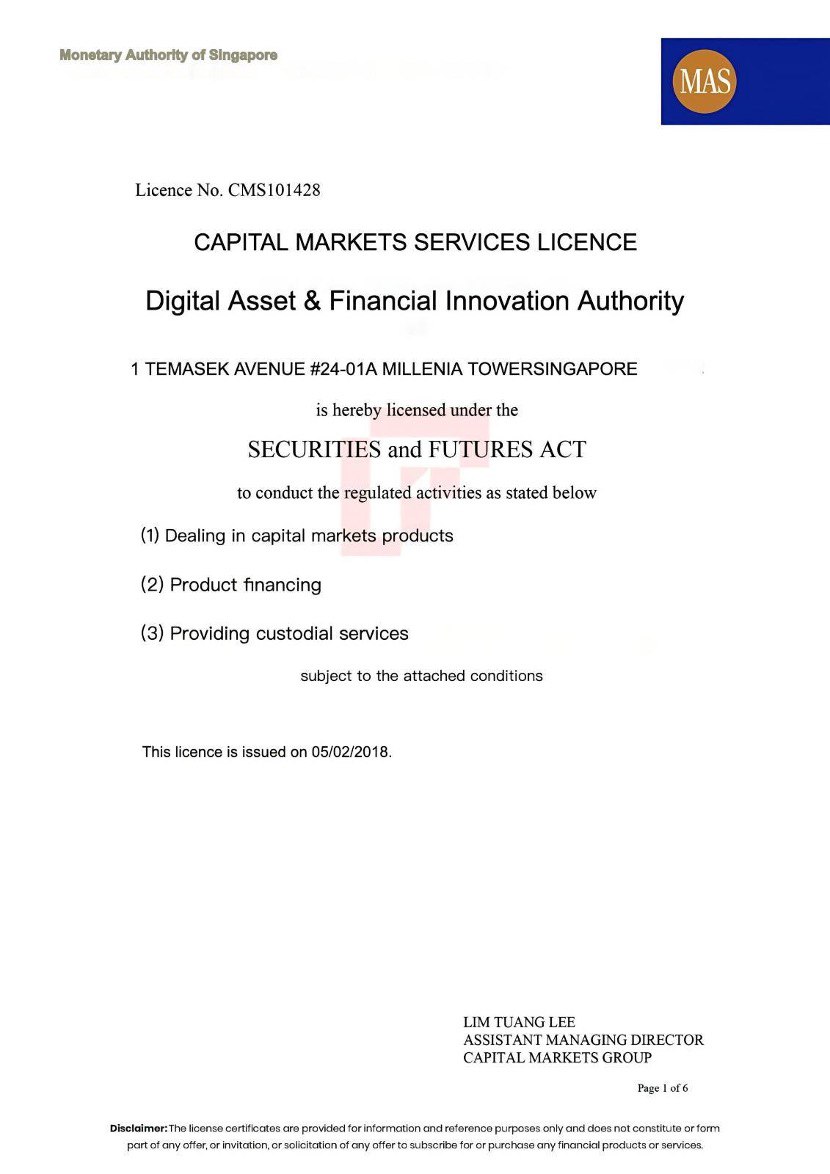

DAFIA

The Digital Asset & Financial Innovation Authority (DAFIA) is an independent financial regulatory authority established by the Singapore government, focused on the compliance management of digital assets, blockchain financial technology, decentralized finance (DeFi), and digital payment services. The core mission of DAFIA is to ensure market transparency, security, and investor protection, while promoting the standardized development of blockchain technology innovation to enhance Singapore’s competitiveness in the global financial market.

DAFIA’s regulatory framework is aligned with that of the Monetary Authority of Singapore (MAS), the UK Financial Conduct Authority (FCA), and the Swiss Financial Market Supervisory Authority (FINMA), ensuring the stability, compliance, and international interoperability of Singapore’s financial market.

Company Address: 1 TEMASEK AVENUE #24-01A, MILLENIA TOWER, SINGAPORE

Regulatory Legal Framework

DAFIA enforces regulation based on the following key regulations:

Digital Asset Compliance & Security Act (DACS): This law defines the compliance standards for digital assets, ensuring transparency, legality, and security in all digital asset trading and management activities, covering everything from exchanges to wallets.

Fintech & Payment Security Framework (FPSF): This regulation provides comprehensive technical standards and security requirements for all fintech and payment solutions, ensuring the stable operation of digital payment platforms and blockchain solutions, as well as risk prevention.

Anti-Money Laundering & Counter-Terrorist Financing Act (AML-CTF): This act requires all licensed institutions to establish strong anti-money laundering and counter-terrorist financing mechanisms to ensure that the financial system is not misused by illegal flows of funds.

Regulatory Scope

DAFIA’s regulatory scope includes, but is not limited to, the following fintech and cryptocurrency activities:

Centralized Cryptocurrency Exchanges (CEX): All centralized trading platforms operating in Singapore must comply with AML/KYC requirements and undergo regular audits.

Decentralized Exchanges (DEX): Decentralized platforms are required to establish effective regulatory compliance frameworks to ensure that trading activities do not disrupt market order.

Stablecoin Issuers: All stablecoin issuers must ensure 1:1 asset backing and undergo regular audits with publicly transparent reports.

Smart Contracts & DeFi Protocols: Strict security reviews are implemented for smart contract code to ensure the functionality and security of decentralized finance protocols.

Digital Asset Payment & Settlement Systems: All systems involved in digital payments and settlements must comply with the industry’s best security practices and regulatory standards.

License Categories

DAFIA License Categories and Applicable Compliance Requirements:

DAFIA Class A - Centralized Cryptocurrency Exchanges: Compliance Requirements:

1:1 Fiat Reserve: Exchanges must ensure that every unit of fiat currency deposited by customers has an equal amount of reserve funds backing it, ensuring the safety of customer funds.

AML/KYC Compliance: Exchanges must implement anti-money laundering (AML) and know-your-customer (KYC) procedures to meet international financial regulatory standards and prevent the flow of illegal funds.

DAFIA Class B - Stablecoin Issuers: Compliance Requirements:

100% Reserve Asset Proof: Stablecoin issuers must ensure that all stablecoins issued are fully backed by sufficient fiat assets to maintain the value stability of the stablecoin.

Quarterly Audits: Issuers must conduct independent third-party audits regularly and submit audit reports to DAFIA to ensure the authenticity and sufficiency of reserve assets.

DAFIA Class C - DeFi Protocols: Compliance Requirements:

Open-Source Code: The source code of DeFi protocols must be open and transparent to allow for community and developer review and improvement, ensuring the security and compliance of smart contracts.

Security Audits: All DeFi protocols must undergo third-party professional security audits to ensure that there are no potential vulnerabilities or risks.

DAO Governance: DeFi protocols must implement decentralized autonomous organization (DAO) governance mechanisms, ensuring that community members have the right to participate in the decision-making and management process of the protocol.

License Application Requirements

Minimum Capital Requirements:

Class A: $500 million liquid funds + 1:1 reserve asset proof

Class B: $400 million reserve funds + regular transparency reports

Class C: $200 million capital + smart contract security audit report

Technical and Security Compliance Requirements:

Exchanges must provide comprehensive AML/KYC compliance plans and pass annual audits.

All smart contracts must undergo DAFIA’s security testing and validation.

DeFi protocols must implement transparent governance and publish DAO voting mechanisms.

Regulatory Obligations

All licensed institutions must undergo annual reviews and supervision by DAFIA. Exchanges must provide quarterly reserve asset proofs to ensure 1:1 redemption capability and report operational status to DAFIA within the statutory period. DeFi protocols must undergo regular smart contract security testing and submit the test reports to DAFIA.

Penalty Mechanisms

Violations will be strictly penalized, including but not limited to:

Failure to comply with KYC/AML requirements

Insufficient reserve funds by stablecoin issuers

Improper customer funds management by exchanges

Penalty Measures:

Initial Violation: Fines of $10M - $50M

Severe Violations: License revocation, notification to international financial regulatory authorities, and imposition of corresponding international financial market entry bans.