WorldWealth Management Group is a financial technology company incorporated in Hong Kong and licensed by the Securities and Futures Commission (SFC). We specialize in providing a full range of digital asset services for professional users, covering core functions such as virtual asset trading, asset management, strategy allocation and liquidity products.

We are committed to building a safe, compliant and transparent crypto asset trading ecosystem, adhering to the requirements of Hong Kong laws and regulations, and continuously improving the user experience and consistency of regulatory standards.

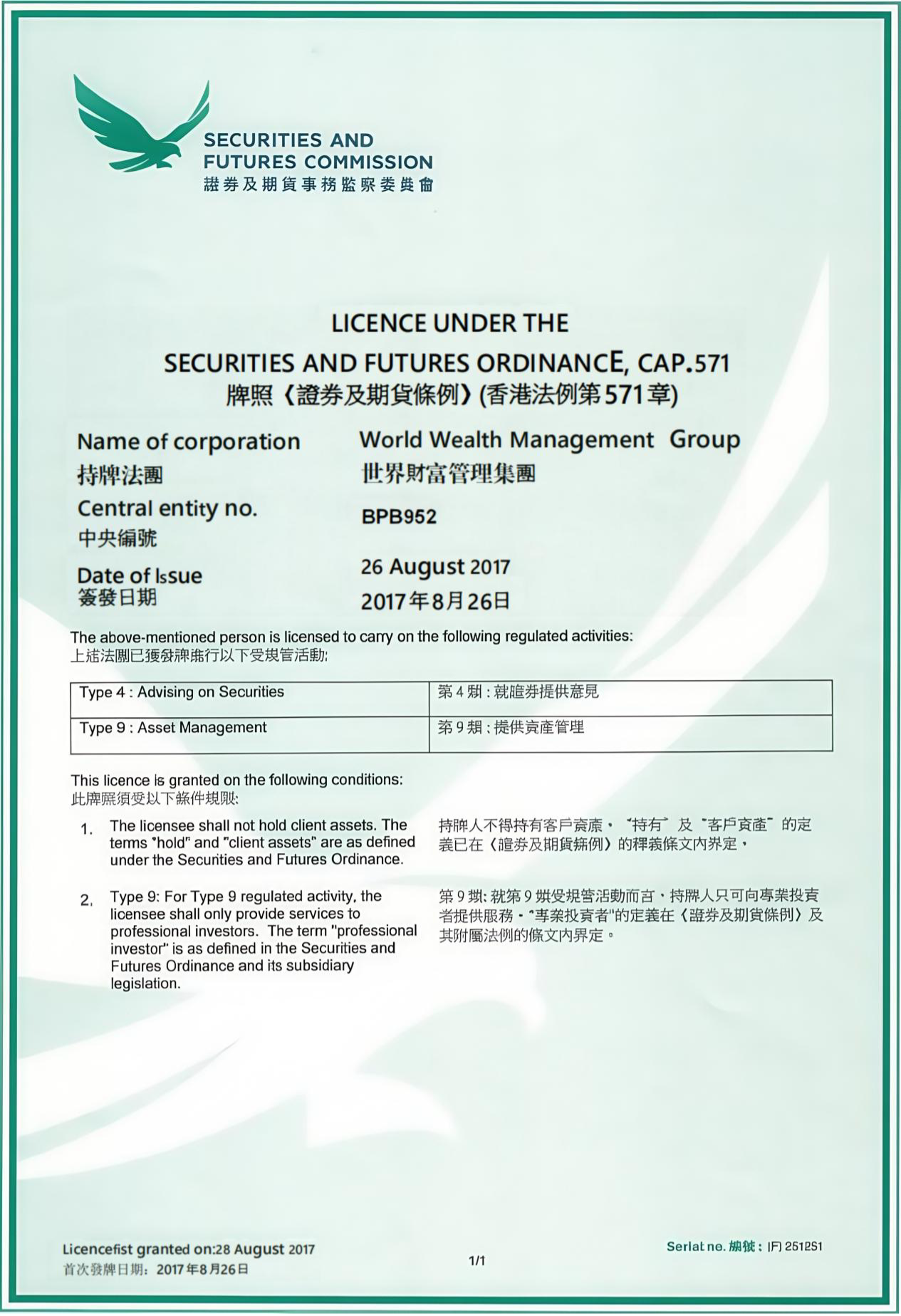

License Information

Licensed Company Name: WorldWealth Management Group

Central Number: BPB952

Regulator: Hong Kong Securities and Futures Commission (SFC)

Applicable Laws: Securities and Futures Ordinance (Cap. 571)

Licensing Date: August 26, 2017

Licenses granted

Class 4 license Providing investment advice on securities and virtual assets (Advising on Securities)

Class 9 license Providing asset management services (Asset Management)

Crypto-asset services supported by the platform (covering core exchange functions)

All services are based on a compliance structure, with risk control and regulation in accordance with the Hong Kong legal framework.

Supported services include:

Spot cryptocurrency trade aggregation (buy/sell aggregation engine supports mainstream tokens)

Leveraged trading and margin functions (user risk assessment and qualification confirmation required)

Perpetual and option-based contract trading (based on institutional liquidity docking, compliance limits)

Strategy products and asset portfolio allocation (based on Class 9 license to carry out)

Crypto asset management and investment advice (professional investors can enjoy customized allocation)

Digital Asset Pledge & Income Products (transparent income structure and clear risk disclosure)

Custody solutions and wallet services (supported by qualified custodians)

Data-driven market analytics and investment advisory tools (operating under Class 4 compliance)

Statement of Compliance and Limitations

All asset management and investment advice services are only available to “professional investors”.

The platform does not directly hold client assets, which are managed by a qualified third party custodian.

All strategy, investment and derivative services come with full risk disclosure and suitability assessment.

Strict compliance with KYC, AML/CFT requirements and SFC's ongoing regulatory standards

All platform technologies and systems comply with financial information security and disaster recovery standards.

Risk control and transparency system

Complete segregation of accounts and assets

Real-time risk control system and position limiting mechanism

Disclosure of return/leverage/risk details for all products

Full traceability of customer funds/transactions/investments

Regular compliance audits and financial reporting to regulators