WorldWealth Management Group is a financial services company registered in Abu Dhabi.

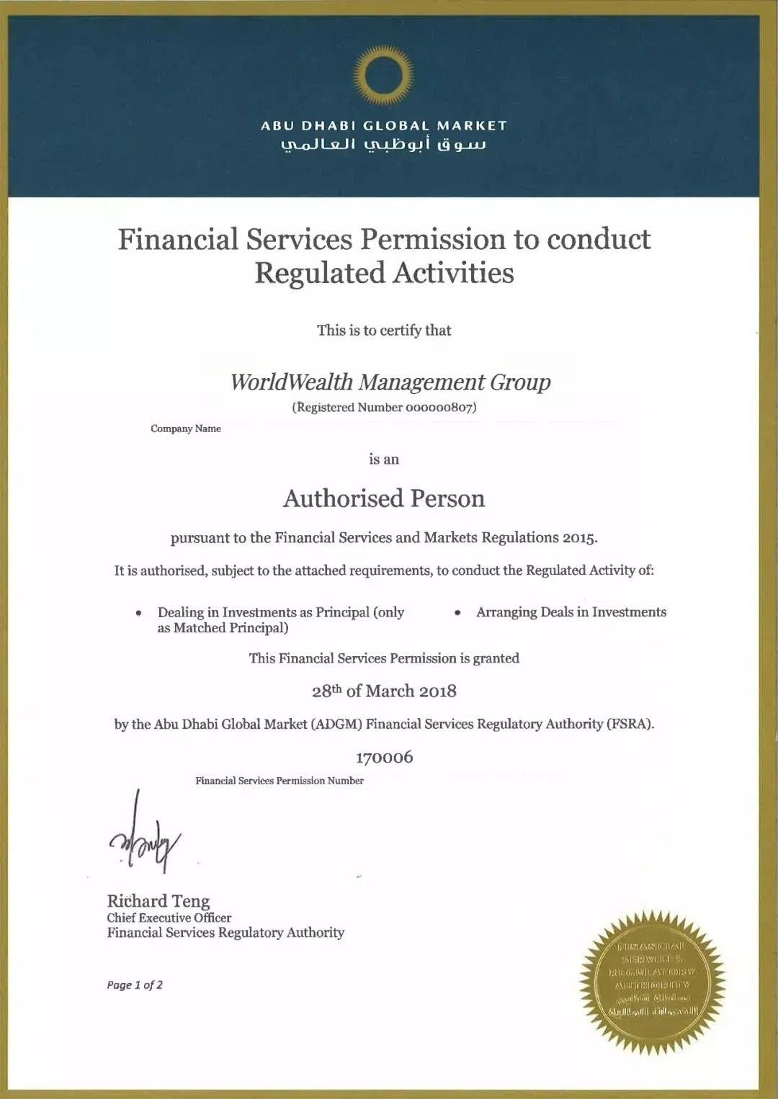

WorldWealth Management Group holds a securities dealer license under Section 46(1) of the Securities Law (2007), license number 170006, and is authorized to engage in securities dealer activities as regulated under Section 46(2) of the Financial Services Regulatory Authority (FSRA) Law.

This license is issued by the Abu Dhabi International Fintech & Payment Authority (IFPA), the FSRA. Under our license, WorldWealth Management Group is authorized to engage in the trading of securities, derivatives, and foreign exchange contracts.

Company Address: Island, Al Khatem Tower - Al Maryah Island - Abu Dhabi Global Market Square - Abu Dhabi.

Our company has affiliations with and external cooperation with entities regulated by the FSRA, including WorldWealth Management Group.

About the Abu Dhabi Financial Services Regulatory Authority (FSRA)

The Abu Dhabi FSRA was established under the 2013 Financial Services Regulatory Authority Act. It plays a key role in regulating and overseeing the financial services sector within its jurisdiction.

The FSRA is the primary regulatory authority responsible for ensuring the stability, integrity, and transparency of the Abu Dhabi financial system. Its mandate covers a broad range of financial services, including banking, insurance, securities, and mutual funds. As a comprehensive regulatory body, the FSRA aims to foster a sound and competitive financial services sector.

The FSRA operates under the supervision of the Ministry of Finance, Trade, Investment, and Economic Planning, ensuring that its activities are aligned with national economic policies and regulatory objectives. Its primary mission is to maintain the safety and soundness of financial institutions, protect investors and consumers, and promote market integrity and financial inclusion.

One of the core functions of the FSRA is to issue licenses and regulate financial institutions operating in Abu Dhabi. This includes banks, insurance companies, securities dealers, investment advisers, and other financial intermediaries. Through stringent licensing requirements and ongoing oversight, the FSRA seeks to ensure that these institutions operate prudently, comply with applicable laws, and maintain high standards of corporate governance and risk management.

In addition to licensing and regulation, the FSRA plays a crucial role in formulating and enforcing regulations governing the conduct of financial services providers. These regulations cover a wide range of areas, including anti-money laundering and counter-financing of terrorism (AML/CFT) measures, customer due diligence, market conduct standards, and prudential requirements. By setting clear rules and standards, the FSRA aims to foster market discipline, protect consumers from financial misconduct, and enhance the overall stability and integrity of the financial system.

Furthermore, the FSRA is also a leading institution in Abu Dhabi for promoting investor education and consumer awareness. Through various outreach programs, seminars, and publications, the FSRA educates the public about financial products, investment risks, and consumer rights. By empowering individuals to make informed financial decisions, the FSRA aims to enhance financial literacy, build trust in the financial system, and protect the interests of investors and consumers.

Another significant aspect of the FSRA's role is to promote the development and growth of Abu Dhabi’s financial services industry. This includes fostering innovation, encouraging investment, and creating a favorable regulatory environment for financial innovation and technology (FinTech). By embracing technological advances and supporting innovative business models, the FSRA seeks to enhance the competitiveness and resilience of Abu Dhabi’s financial sector in the global market.